ABOUT CKPOWER

CKPower Public Company Limited (the “Company” or “CKP”) was founded by CH. Karnchang Public Company Limited Group (“CH. Karnchang Group”) , registered its incorporation on June 8, 2011

To be one of the region’s largest producers of electricity from renewables with one of the lowest carbon footprints

OUR BUSINESS

HYDRO POWER

CKPower holds shares in the Nam Ngum 2 Hydroelectric Power Plant, representing 46 percent of the registered and paid-up capital in Nam Ngum 2 Power Company Limited (“NN2PC”) and also hold shares in Xayaburi Power Company Limited (“XPCL”), representing 37.5 percent of XPCL’s registered and paid-up capital.

COGENERATION

CKPower holds shares in Bangpa-in Cogeneration Limited (“BIC”) representing 65 percent of its registered and paid-up capital. BIC is a producer and distributor of electricity and steam from the natural gas-fired cogeneration power which consists of two projects: BIC1 and BIC2.

SOLAR POWER

CKPower holds shares in Bangkhenchai Company Limited (“BKC”) representing 100 percent of its registered and paid-up capital. Furthermore, BKC has invested in the Monocrystalline solar power plants, consisting of five solar rooftop power plant and one solar farm power plant.

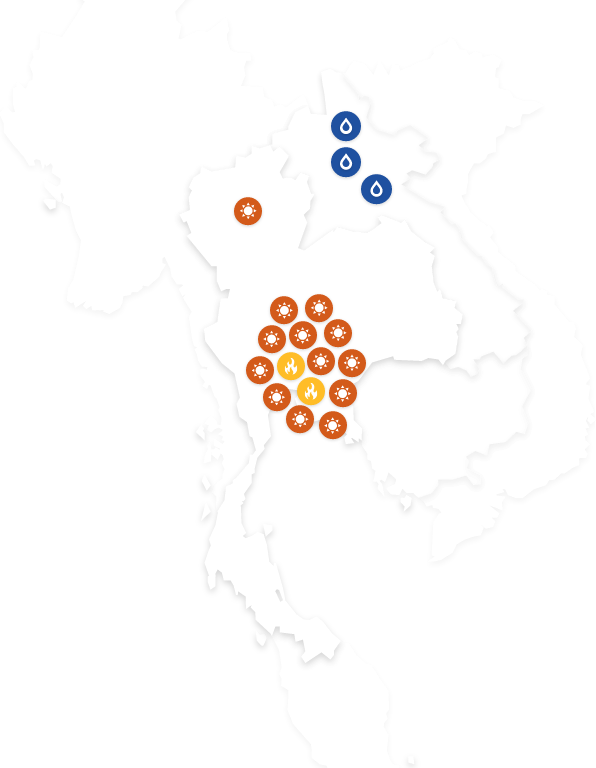

OUR FOOTPRINT

The Company currently invests in companies operating the business of production and distribution of electricity in three types of power plants, which are, Hydroelectric Power Plant, Cogeneration Power Plant, and Solar Power Plant, divided into investment in a total of seven subsidiaries and associated companies

HYDRO POWER

PROJECTS IN LAO PDR

SOLAR POWER

PROJECTS IN THAILAND

COGENERATION

PROJECTS IN THAILAND

INVESTOR CORNER

Welcome to CKP Investor Relations. Here you will find all information about the Company’s key figures, share, strategy, and financial events.

CORPORATE GOVERNANCE

With realizing the significance of operations in accordance with the Principles of Good Corporate Governance, the Board of Directors then sets out the Corporate Governance Policy in writing to ensure the corporate practical guidelines with clarity, transparency and auditability

WHAT’S UPDATE

Follow the updates of corporate information and upcoming events

WE’RE LOOKING FOR TALENTED PERSONNEL

If you’re talented, hardworking, and love to be part of a team, then you’ll fit right in.